Working with Toth Financial

We’re Here For You.

And we’ll be there every

step of the way.

And we’ll be there every

step of the way.

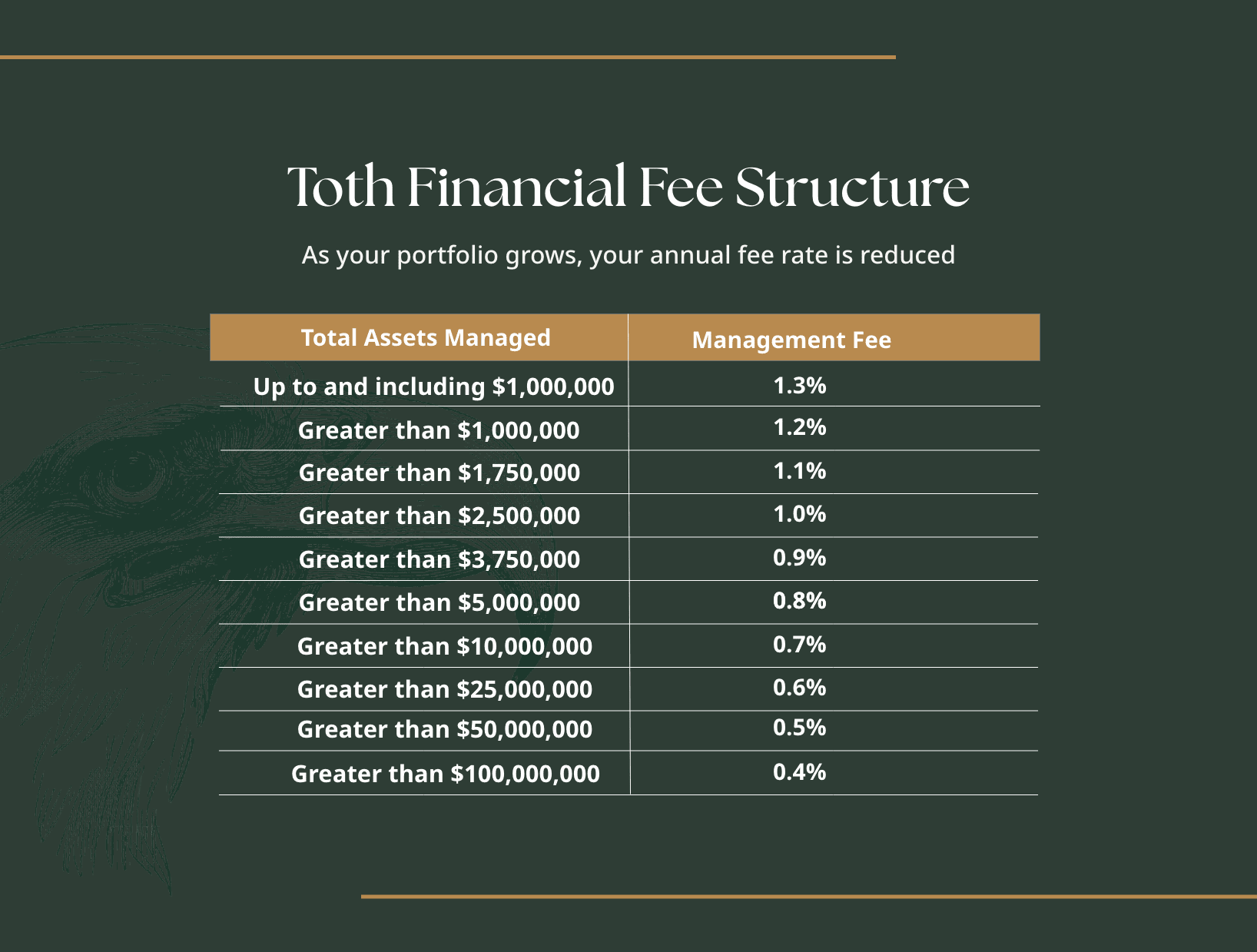

We understand that the investment world can be complex and uncertain. Toth Financial works closely with clients who have a minimum of $1 million of investible assets and are looking for guidance and a personal relationship to help navigate through the uncertainty. When markets are turbulent, our team knows how to filter out the noise, without losing sight of our clients’ goals.