As 2023 began, the likelihood of a recession and negative stock market returns seemed inevitable. Contrary to widespread belief, the S&P 500 defied expectations, concluding the year with an impressive 24.23% gain.

Much of 2023 reflected the ongoing uncertainty and conflicting narratives that originated in 2022 during the Federal Reserve’s early days of their battle against inflation. Over this two-year period, the Fed aggressively raised key interest rates at an unprecedented pace resulting in increased costs for corporate debt, new mortgages, and consumer debt among many other impacts.

As the transition from 2022 to 2023 unfolded, economic indicators continued to exhibit strength and resilience, leading major money managers to interpret that the Fed was struggling to control inflation. Therefore, in 2023, positive news became a cause for concern, and negative news was seen as a positive signal. For instance, in pre-COVID years, a 5.2% GDP growth rate would have been celebrated, but when reported for Q3 in 2023, this caused markets to pull back signaling lingering inflation concerns. Investors were patiently awaiting signs of economic weakness to believe the Fed was nearing the end of their rate hike cycle or a concise announcement from the Fed itself which materialized in the last quarter of the year.

The substantial gains of the S&P 500 throughout much of 2023 were primarily driven by optimism surrounding Artificial Intelligence (AI) and a select few company stocks involved with the new technology (commonly referred to as the magnificent seven). It wasn’t until challenges in the job market, decades of high mortgage rates, and the Fed changing their tone on rate cuts in the year ahead that the market finally turned higher in November with breadth. The positive change this time around was the number of company stocks participating (known as market breadth) signaling a healthy and robust foundation for a sustained bull market.

In December, the Fed announcement gave a figurative ‘green light’ to begin deploying cash that has been sitting on the sidelines. The change in messaging from “no rate cuts in the future” to “we could see 3 rate cuts in 2024” altered the expectation to reduced borrowing costs in the year ahead which prompted companies, households, and consumers to resume spending. At the time of the Fed’s announcement, a record $5.898 trillion of cash remained ‘parked’ in Money Market funds. With the interest rate environment now more stable and the near future clarified, it is anticipated that these funds will be redirected to other investments and equities will benefit.

Looking ahead to 2024, the focus will be on the Presidential election news and an interesting year it will likely be. However, the assurance that neither party is likely to push significant changes through Congress provides a sense of stability for businesses. More important for market clarity will be the action of the Federal Reserve. If the Fed can squeeze the last remnants of inflation from this economy, then one may expect positive investment outcomes. Therefore, maintaining a portfolio of consistently performing company stocks will remain our focus. With a resilient economy through 2023, the potential of getting inflation in check, a broadening in the breadth of stock participation, and the amount of cash still ‘parked’ in Money Market funds, we anticipate 2024 to be a positive year for market returns.

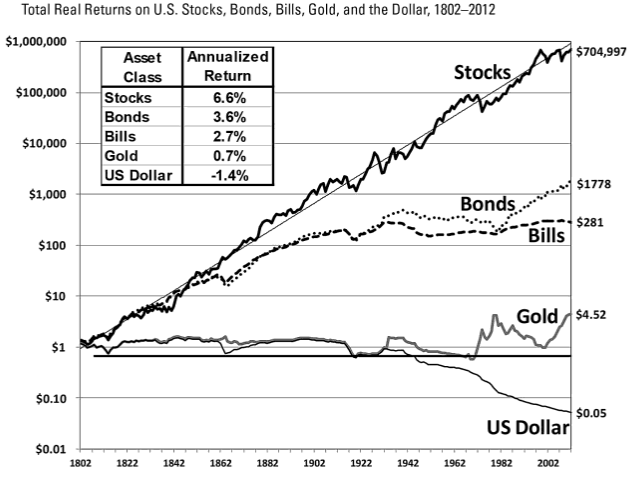

Lastly, included below is a graph that demonstrates real returns by asset class over time. While this graph may be a little dated, it provides an appreciable depiction that underscores our point that sound investments and patience will deliver positive results.

Source: Jeremy Siegel’s book, Stocks for the Long Run

| Thomas A. Toth, Senior Chairman | Kenneth Bowen, II President & CEO |