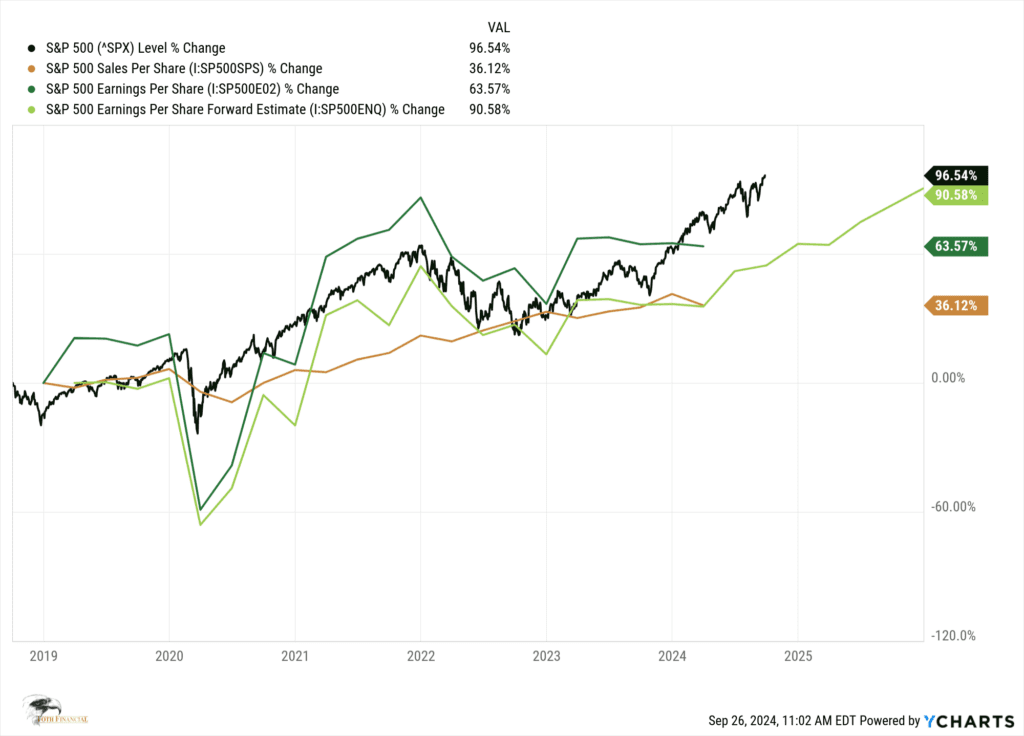

As we close out the third quarter, the S&P 500 is up 20.8% for the year to date. This result may come as a surprise to many investors wondering, “How is this possible, given the broader economic challenges?” The answer is that markets typically follow earnings over the long term. In this regard, Q3 stands out as the fifth consecutive quarter of positive year-over-year earnings growth for the S&P 500 Index, alongside an impressive sixteenth straight quarter of positive revenue growth. This steady and substantial earnings performance is a clear driver behind the market’s continued upward trajectory and reinforces the underlying strength of many key companies.

At the September Federal Reserve meeting, the Fed made a notable move by implementing its first interest rate cut of this cycle, surprising market participants with a larger-than-expected reduction of 0.50%. This marks the beginning of an easing phase in monetary policy, a pivotal moment that signals the potential end of the prolonged inflationary fight. The implications of this shift are significant: a gradual reduction in rates suggests confidence in the broader economic outlook and a measured approach to monetary policy, which is generally bullish for equities. On the other hand, if the Fed were to start cutting rates at a more aggressive pace, it might signal underlying concerns or even panic, which would likely be viewed as bearish by the markets.

So far, the Fed has maintained a high level of transparency throughout this interest rate cycle, consistently meeting market expectations. This clarity is a reassuring factor for investors, as it points toward the possibility of achieving the much-discussed “soft landing” for the economy—a scenario in which inflation is brought under control without tipping the economy into a recession. The Fed’s clear communication and adherence to expectations have instilled confidence, suggesting a more stable path ahead, particularly as we enter a critical phase for the economy.

Looking forward, we are now just weeks away from the 2024 Presidential Election. Historically, October has often been the weakest month of the fourth quarter, particularly in election years. As uncertainty looms ahead of the election, we wouldn’t be surprised to see the markets take a breather this month. Given the Fed’s current rate-cutting cycle, however, and the rate-cutting measures being enacted by other major central banks across the globe, any pullback is likely to be shallow. Once the election results are known, money managers and institutional investors will have greater clarity, enabling them to proceed with their investment strategies, which should help the market regain momentum. It’s important to note that markets typically dislike uncertainty. But once an “unknown” becomes a “known”—even if the outcome isn’t ideal—the market tends to move past it, shifting its focus to the next event or economic data point.

Beyond the immediate uncertainty surrounding the election, projected earnings for the S&P 500 continue to rise for both 2025 and 2026. This is a positive indicator for the market’s long-term prospects. As we’ve stated in the past, we firmly believe that markets are fundamentally driven by earnings growth. While there may be short-term deviations from this principle due to market sentiment or external factors, the broader trend of positive earnings growth is what consistently pulls markets higher. See image below for visual context.

We continue to believe that consistently performing companies—those that have proven their ability to grow earnings year over year, even in challenging environments—will remain at the core of our investment strategy. These companies not only drive earnings growth but also see their stock prices follow suit over time. This earnings-driven market dynamic is a key reason why we remain optimistic about our core positions.

While near-term volatility may arise, particularly in the run-up to the election, we expect that the ongoing positive earnings trajectory, combined with a more favorable monetary policy environment, will support continued market gains. Our investment philosophy remains focused on long-term, consistently performing companies that have demonstrated resilience across multiple economic cycles. We believe that this approach positions us well to navigate whatever market conditions may arise in the months ahead.

| Thomas A. Toth, Senior Chairman | Kenneth Bowen, II President & CEO |